Debits Will Increase Unearned Revenues and Revenues.

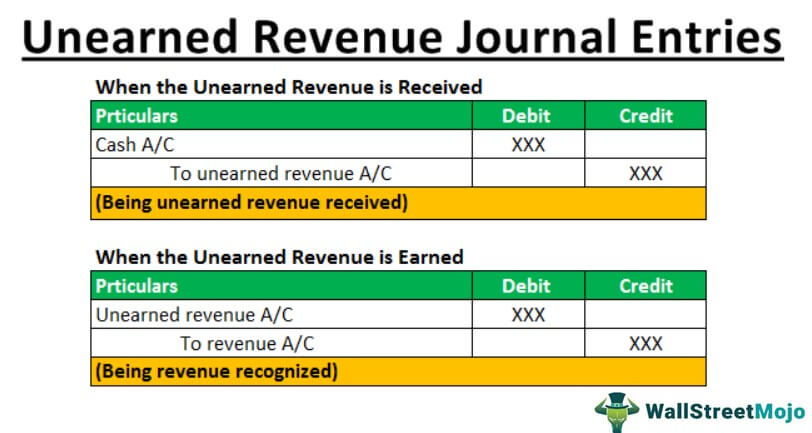

The revenue recording in the accounting books of an entity is necessary to calculate the net income. When the business provides the good or service the unearned revenue account is decreased with a debit and the revenue account is increased with a credit.

Unearned Revenue Online Accounting

Revenues are increased by debits.

. All owner s equity accounts record increases to the accounts with credits. When a transaction is recorded all debit entries have to have a credit entry that corresponds with. Creates a debit increase to assets cash Creates a credit increase to liabilities deferred revenue.

Has the performance obligation to provide the service to its client in the next three months. Debits will increase unearned revenues and revenues. Revenues are increased by debits.

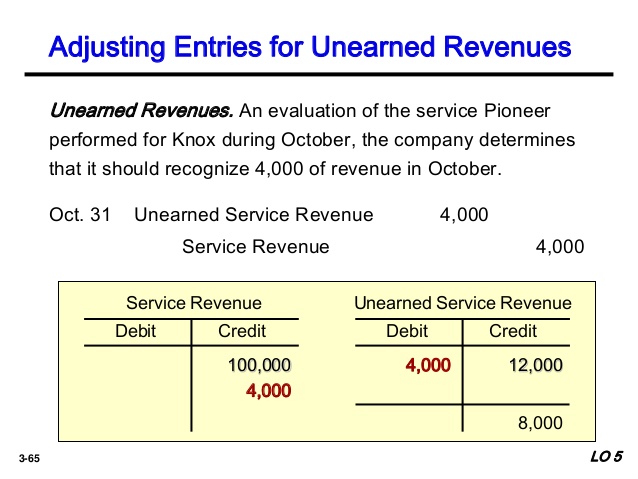

Adjustments for unearned revenues. C Increase assets and increase revenues. As a company earns the revenue it reduces the balance in the unearned revenue account with a debit and increases the balance in the revenue account with a credit.

Therefore the corresponding debits. This means youll debit the unearned revenue account by 2000 and credit the revenue account by 2000. Decrease liabilities and increase revenues.

Debits will increase Unearned Revenues and Revenues. Likewise both asset cash and liability unearned service revenue increase by 4500 on June 29 2020. Journal entries can have more than two accounts as long as the debits equal the credits.

The unearned revenue account is usually classified as a current liability on the balance sheet. Since it is a cash increase for your business you will debit the cash entry and credit unearned revenue. Revenues have normal credit balances.

The unearned revenue is usually a current liability unless prepayment has been received for the supply of goods or services after a year. Credits are essentially the total opposite. It is a liability because even though a company has received payment from the.

Debit Unearned Revenue and credit Service Revenue. When a company provides the good or service and hence has earned the revenue they have to debit the unearned revenue account in order to reduce its balance and credit the revenue account in order to increase its balance. Click to see full answer.

Does a debit or credit increase an asset account. D Decrease revenues and decrease assets. True or False.

Debits will increase unearned revenues and revenues. Debit Cash and credit Accounts Receivable. The difference between income and revenues is self-explanatory.

AnswerA 58An unconditional written promise to pay a definite sum of money on demand or on a defined future date or dates is an. A Decrease liabilities and increase revenues b Have an assets-and-revenues-account relationship. Assets that are used up during the process of earning revenue are called expenses.

The revenue is yet to be earned by the business and hence the same is credited as a liability. In accounting unearned revenue is a liability. Unearned income or deferred income is a receipt of money before it has been earned.

Unearned revenue is the amount received in advance against any goods or service which will be provided in future. It is a liability account. An example of a general-purpose financial statement would be a report about projected price increases related to transportation.

Where unearned revenue on the balance sheet is not a line item you will credit liabilities. Unearned revenue is a liability for the recipient of the payment so the initial entry is a debit to the cash account and a credit to the unearned revenue account. It is positioned to the left in an accounting entry.

If a business entered unearned revenue as an asset instead of a liability then its total profit would be overstated in this accounting period. Since the cash is received it is the creation of the asset. EEntries that decrease asset and expense accounts or increase liability equity and revenue accounts are posted as debits.

First off deferred revenue and unearned revenue are ultimately the same thingessentially prepayment for goods or services yet to be delivered. The revenues of a company are the net sales proceeds. From the accounting point of view the Unearned Service Revenue account is credited 1200.

Revenues are a positive factor in the computation of net income. Credits decrease asset and expense accounts. Adjustment will decrease balance sheet accounts like assets liabilities and stockholder equity and increase income statement accounts like expenses and revenues because as unearned revenue is money paid in advance it is originally written as debit to cash accounts and credit to unearned revenue accounts because it is money received.

Simply so why is unearned revenue a liability. Recorded as liability on the balance sheet. Credits increase liability equity and revenue accounts.

The process is simple in cash basis. Unearned revenue is the revenue a business has received for a product or service that the business has yet to provide to the customer. However the income represents the net of revenues and expenses.

Debits serve to increase expense or asset accounts while reducing liability equity or revenue accounts. If a company were not to deal with unearned revenue in this manner and instead recognize it all at. A debit is an accounting entry that either increases an asset or expense account or decreases a liability or equity account.

On the other hand revenue will be recognized and revenue account balance will be increased Journal Entry will be as follow. Debit the cashbank account with the total amount received ie 6000 and create a current liability of unearned revenue by crediting the same amount. The accounting treatment is as follows.

The debit-credit rule also requires the increase in liabilities to be credited. On a balance sheet the assets side must always equal the. Any adjusting entry in this account will decrease it.

The incurring of obligation to perform future advertising service increases a liability an Unearned Service Revenue of 1200 in FAC. In this journal entry the 4500 is recorded as a liability because the company ABC Ltd. Revenues increase owners equity.

Unearned Revenue Journal Entries How To Record

No comments for "Debits Will Increase Unearned Revenues and Revenues."

Post a Comment